U.S. natural gas storage. (Source: Shutterstock)

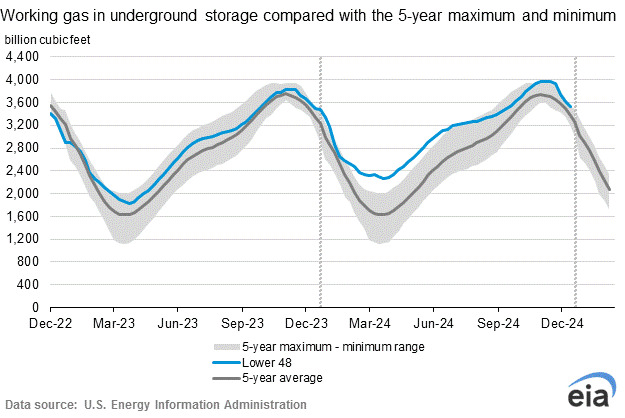

The U.S. Energy Information Administration (EIA) reported that the nation’s natural gas storage levels for the week ending Dec. 20 fell by 93 Bcf from the week before to a total of approximately 3.53 Tcf in storage.

Stocks of natural gas are currently 166 Bcf above the EIA’s five-year average and 14 Bcf above last year’s total.

Meanwhile, during the last full week of 2024, natural gas front-month futures at the Henry Hub remained at the highest levels in two years. During early trading, the Henry Hub price had fallen $0.04 to $3.68/MMBtu.

Henry Hub prices have been at or above $3.50/MMBtu since mid-December.

The EIA released the data on Dec. 27, a Friday, instead of the usual Thursday because of the Christmas holiday.

Recommended Reading

Surge Energy Balancing M&A Hunt with Testing Midland’s Shallow Zones

2024-12-05 - Surge Energy’s Travis Guidry discusses the potential for $1.3 billion in Permian Basin M&A and the company’s quest to grow inventory organically.

Post Oak Capital Backs Permian Team, Invests in Haynesville

2024-10-11 - Frost Cochran, managing partner at Post Oak Energy Capital, said the private equity firm will continue to focus on the Permian Basin while making opportunistic deals as it recently did in the Haynesville Shale.

Hollub: Oxy Low Carbon Ventures Bolsters US Energy Independence

2024-11-18 - Occidental Petroleum is making a number of low-carbon moves in the Permian—a maneuver that will bolster the U.S.' energy independence, CEO Vicki Hollub told Hart Energy in an exclusive interview.

Quantum Teams Looking for Acquisitions ‘Off the Beaten Path’

2024-10-14 - Blake Webster, partner at Quantum Capital Group, said the private-equity firm’s portfolio teams are looking to buy from sellers looking for cash buyouts, though not necessarily in the usual places.

Boosted by Oxy Deal, Permian Resources Expects to Grow in Delaware

2024-11-21 - Permian Resources Co-CEO Will Hickey expects more growth in the Delaware Basin thanks to his company’s advantageous cost structure.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.