Spicewood said the recent acquisitions offer both in-place yield and early-stage development potential, featuring sub-$40/bbl breakeven operator returns. (Source: Shutterstock)

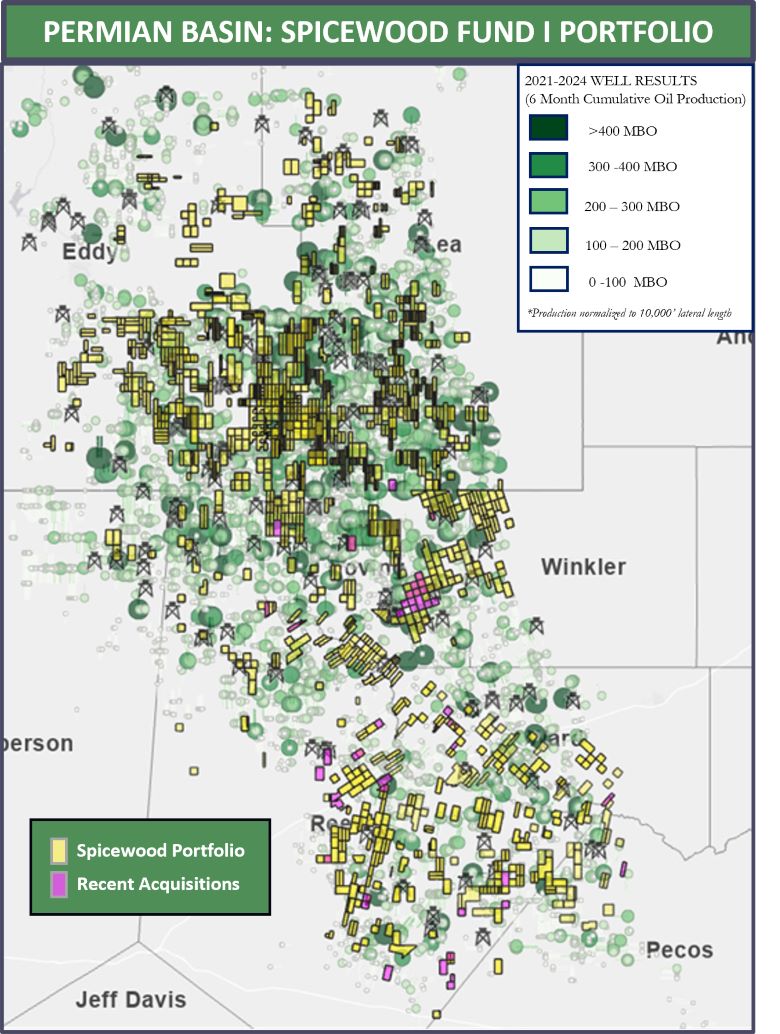

Spicewood Mineral Partners has executed multiple new minerals and royalties acquisitions in the Permian Basin, the company said in an Oct. 22 press release. Spicewood said the acquisitions are part of a recent effort to acquire a selection of Tier 1 assets in the Permian.

Dallas-based Spicewood did not disclose financial details of the five transactions.

Spicewood said it acquired:

- An “early-life,” 90% undeveloped mineral tract in the Delaware that offers potential significant upside through resource development and timing advantages. Recent activity includes Occidental Petroleum filing a lease in the neighboring section and several operators farming-in nearby to accelerate timing and reserves;

- A higher-yielding asset with mineral interests in the Delaware and Midland basins, operated by Oxy and HighPeak Energy. The deal includes production-ready assets and significant future development opportunities. Approximately 60% of the inventory remains with a mix of sub-$40/bbl opportunities and longer-term potential;

- Mineral interests in Ward County, Texas, considered to have strong production potential, supported by proximity to key operators such as Oxy and ConocoPhillips;

- Mineral interests in northern Reeves County, Texas, associated with BP. The unit is one of BP’s last remaining long-lateral developments in the core of the basin, indicating significant near-term development focus; and

- Mineral interests across the Delaware Basin with strong near-term cash flow and future development potential. Spicewood said 18% of the asset is in proved developed producing, with the majority of inventory having breakevens below $35/bbl.

Spicewood said the recent acquisitions offer both in-place yield and early-stage development potential, featuring sub-$40/bbl breakeven operator returns.

“These uncorrelated, low-volatility assets offer a senior secured status for cash flow, tax advantages, and inflation protection, representing an emerging institutional asset class,” said John Golden, Spicewood co-founder and partner. “Additionally, we expect these assets to provide meaningful quarterly distributions to our partners, underscoring our commitment to delivering consistent risk-adjusted returns.”

Recommended Reading

Oxy CEO Sheds Light on Powder River Basin Sale to Anschutz

2024-11-14 - Occidental is selling non-core assets in the Lower 48 as it works to reduce debt from a $12 billion Permian Basin acquisition.

Freehold Closes $182MM Acquisition of Midland Basin Interests

2024-12-16 - Freehold Royalties’ acquisition from a private seller includes around 1,300 boe/d of net production and 244,000 gross drilling acres largely operated by Exxon Mobil and Diamondback Energy.

Brigham Exploration Grows Permian Footprint in Non-Op Assets Deal

2024-12-17 - Brigham Exploration is significantly adding to its Permian Basin non-operated portfolio with an acquisition of 7,000 acres from Great Western Drilling.

Crescent to Double, Largely Through M&A, in the Next Five Years, CEO Says

2024-10-23 - Crescent Energy CEO David Rockecharlie said that after closing the SilverBow acquisition, the company is continuing to hunt for new assets, although few make it past the company’s screening process.

Orion Acquires SCOOP/STACK Interests, Pursuing Permian Deals

2024-11-11 - Orion Diversified Holding Co. is pursuing negotiations with several oil companies in the Permian Basin to acquire oil and gas assets, the company’s CEO said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.