Ovintiv is running six rigs in the Permian, which brought 42 wells online during the second quarter. (Source: Shutterstock)

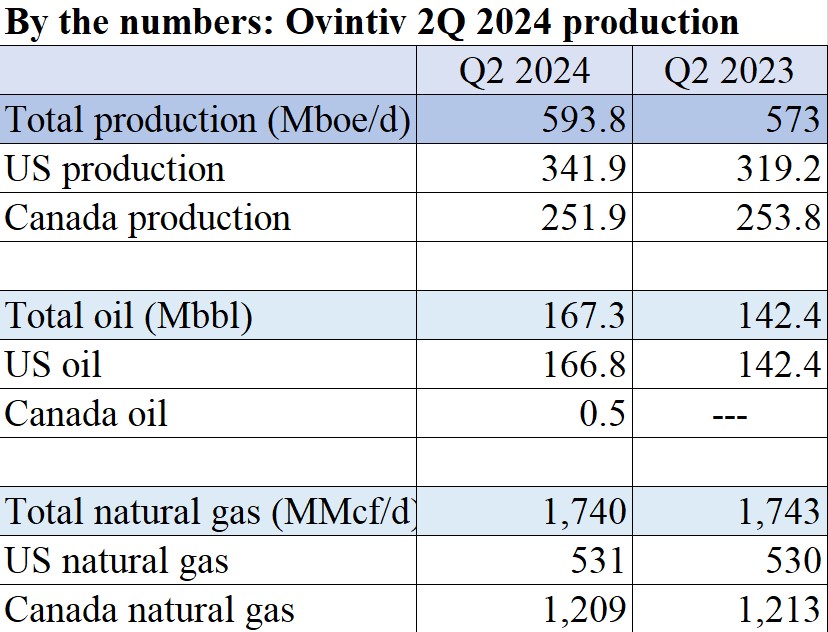

Diverse, multi-basin operator Ovintiv’s production during the second quarter met or exceeded guidance across its commodity lines, positioning the firm this year to generate $1.9 billion in free cash flow and increase production expectations for a second time.

And, management says, they can do it again.

“Our second quarter results demonstrate our focus on strong, consistent operational execution,” said Ovintiv President and CEO Brendan McCracken during a July 31 conference call with investors. “We are converting that execution into bottom line results with durable returns on our invested capital.”

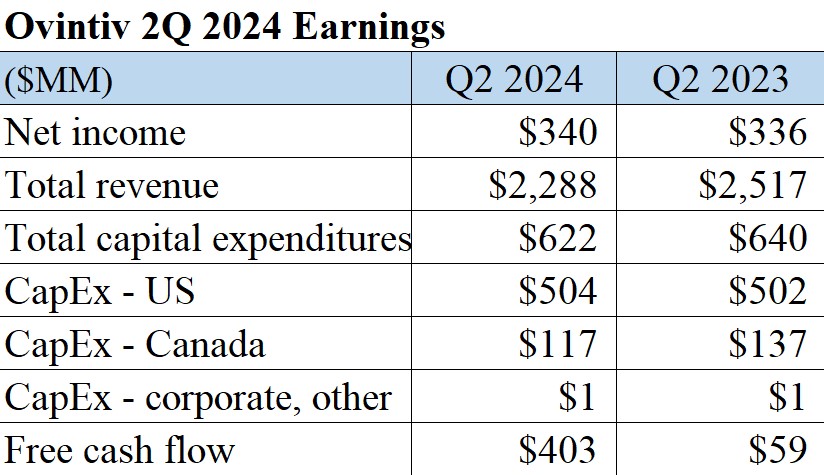

The firm spent $622 million between April and the end of June, which is in line with its $2.3 billion 2024 capital budget.

“Our 2024 program is repeatable in '25 and beyond, allowing us to sustain approximately 205,000 barrels a day of oil and condensate production with capital investment of about $2.3 billion for the next seven to 10 years, assuming flat commodity prices,” McCracken said. “This outcome reflects our leading capital efficiency and the depth of our premium inventory.”

No E&P earnings call would be complete without a nod to trending consolidation in the Permian Basin, which exceeded $30 billion in the second quarter. JP Morgan analyst Arun Jayaram delivered, asking McCracken about recent speculation that Ovintiv is among those courting a trade with Double Eagle in a potentially “large Midland Basin” transaction.

“Is there any credibility to some of these reports?”

McCracken was circumspect. He opted to stick to the scripted message of Ovintiv’s second-quarter success.

Leading operators across the Permian are becoming more technically sophisticated, and the practice is positioning Ovintiv to generate a 20% capital efficiency gain year-over-year, he said.

“It’s really hard to catch up if you if you haven't been stacking these innovations across your business all the way along,” he said. “That leaves us in a place where prosecuting our strategy means really focused on getting better, not just on getting bigger.”

Ovintiv’s beat and raise results were unequivocally positive, said Gabriele Sorbara, managing director of equity research at Siebert Williams Shanks in a research note.

“We believe [Ovintiv] is poised for continued execution on the operational front in the coming quarters,” he said.

Ovintiv dropped the news of its second-quarter performance after market close on July 30. The company’s stock began trading with a bang on July 31 with a 6% bounce from its prior day closing price of $45.98/share to $48.73/share. By market close, the price had settled at $46.44/share.

Permian, Montney outperformance

Ovintiv is running six rigs in the Permian, which brought 42 wells online during the second quarter—doubling the number of wells added during the first three months of the year, said COO Greg Givens.

“Ovintiv remains an industry leader in the Midland Basin in several key categories including Trimulfrac, wet sand, drilling speed, supply chain and logistics management,” he said. “Our outstanding performance is driving the strong capital efficiency you see in our business today.”

In the Montney Shale, drilling and completions (D&C) metrics are outperforming too, Givens said. During the first half, Ovintiv drilled an average 1,750 ft per day and completed more than 4,275 ft per day—a speed similar to its trimul-frac averages in the Permian.

“The Montney has the lowest well cost in the portfolio and our team delivered a pacesetter D&C well cost of less than $500 (per foot) in the quarter,” Givens said. Our low well cost, superior well productivity and strong price realizations for both condensate, as well as natural gas, meaning that the economics in our Montney wells remain outstanding.”

At assumed prices of $75/bbl WTI and $2.50/MMBtu Nymex gas, Ovintiv’s Montney program can generate a program level IRR upward of 60%, he said.

“Our performance in the Montney continues to demonstrate the expertise of our team and our leadership position in the play. Across numerous key metrics, Ovintiv screens is the top of the peer group,” Givens said. “We have the best capital efficiency on both a boe basis and an oil and condensate basis, coming in 50% to 60% better than the peer average.”

Free cash flowing

Ovintiv’s capital allocation profile generally splits free cash evenly to maintain shareholder returns at 50%, even as a $600 million maturity looms next year, said Ovintiv CFO Corey Code.

“The outlook we have for free cash flow puts us in a good spot where we can handle [the maturity] within our existing framework. We've got a fair amount of time before that, so we're not committing to whether we have to refinance it or put it on our credit facility,” Code said. “But we do have enough free cash flow, we can make a pretty significant dent in that just organically.”

McCracken added that a key goal for the firm’s free cash is shoring up the balance sheet and driving down leverage.

“I think sitting here today, as we make that progress, it makes sense to stay in that 50-50 model,” he said. “We've always said it's been in the program all the way along: at least 50% of free cash flow [goes] back to shareholders.”

Recommended Reading

Construction on Kinder Morgan’s Tennessee Pipeline Delayed by Stay

2024-10-15 - An appeals court panel put two permits on hold for Kinder Morgan’s pipeline to consider the project’s implications on the Clean Water Act.

Analysts: DOE’s LNG Study Will Result in Few Policy Changes

2024-12-18 - However, the Department of Energy’s most recent report will likely be used in lawsuits against ongoing and future LNG export facilities.

Trump Prepares Wide-Ranging Plans to Boost Gas Exports, Oil Drilling

2024-11-26 - Sources say that Trump will lift Biden's pause on LNG export licenses, expedite drilling permits on federal land and boots auctions of offshore drilling leases.

Exclusive: Arbo Monitoring Courts, Congress Amid Energy Policy Shifts

2024-12-09 - Chip Moldenhauer, CEO and founder of energy analytics company Arbo, gives insight into regulatory impacts the energy sector should watch for entering 2025, in this Hart Energy Exclusive interview.

Commentary: Maximizing the Opportunity for Energy Dominance

2024-12-18 - Energy produced in the U.S. already has a strong grip on global markets. But with the country on the cusp of a new regulatory environment, will the U.S. capitalize on the opportunity to maximize energy dominance?

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.