The Biden administration’s new five-year plan phases down oil and gas leasing in the Gulf of Mexico. (Source: Shutterstock)

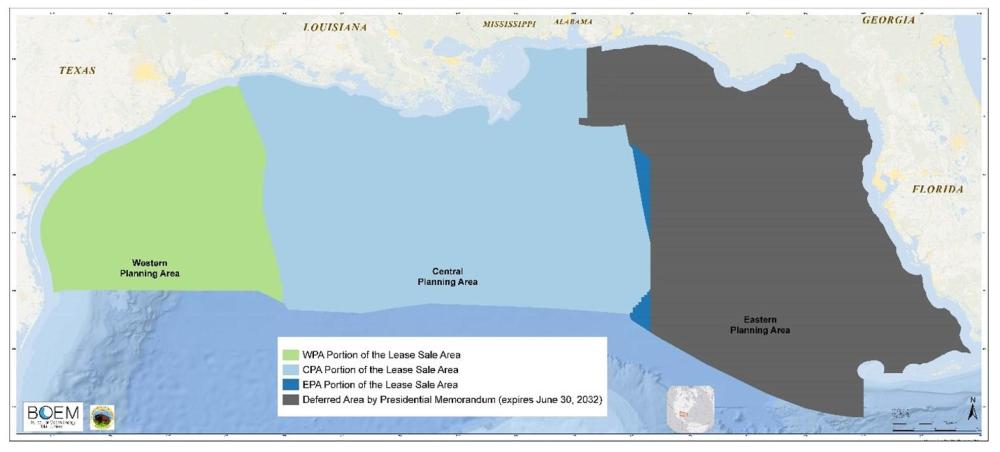

The new offshore leasing program for the U.S. is final, and the only three oil and gas lease sales planned for the five-year window will be in the Gulf of Mexico (GoM).

In late September, the Biden administration proposed a 2024–2029 National Outer Continental Shelf (OCS) Oil and Gas Leasing Program that included the minimum number of lease sales required by the Inflation Reduction Act (IRA) to permit offshore wind lease sales.

The IRA prohibits the Bureau of Ocean Energy Management (BOEM) from issuing a lease for offshore wind development unless the agency has offered at least 60 million acres for oil and gas leasing on the OCS in the previous year. The program schedules oil and gas lease sales in the GoM in 2025, 2027 and 2029.

The Biden administration has a goal of achieving 30 gigawatts of offshore wind by 2030.

At the time the three-sale program was announced, industry leaders criticized the Biden administration’s plan, calling it restrictive and saying it jeopardized the country’s energy security.

In an emailed response regarding the finalization of the program, NOIA President Erik Milito told Hart Energy that the Biden administration’s severe limit of oil and gas leasing curtails access to a critical national asset.

“The White House simply ignores energy realities by once again limiting U.S. energy production opportunities. With global demand at record levels and continuing to rise, regressive policies will harm Americans of all walks of life by putting upward pressure on prices at the pump, destroying good-paying jobs that form the fabric of Gulf Coast communities and relinquishing geopolitical advantages of energy production to countries like Russia, Iran and China,” he wrote.

He said policies that limit domestic offshore development will force the U.S. to rely more on energy imports, often from countries with higher emissions.

“This jeopardizes our energy security and economic prosperity and undermines our efforts to reduce emissions and combat climate change—goals purportedly championed by the current administration,” he wrote.

Recent planned lease sales have been sources of contention, with the cancellation of the final three sales in the 2017-2022 plan—GoM Lease Sales 259 and 261 and the Cook Inlet Lease Sale 258.

Lease Sale 261, the subject of legal challenges, has been on-again, off-again. The BOEM is slated to livestream the opening of Sale 261 bids on Dec. 20.

Recommended Reading

DOE: ‘Astounding’ US LNG Growth Will Raise Prices, GHG Emissions

2024-12-17 - The Biden administration released Dec. 17 a long-awaited report analyzing the effects of new LNG export projects, which was swiftly criticized by the energy industry.

Analysts: Trump’s Policies Could Bring LNG ‘Golden Era’ or Glut

2024-11-27 - Rystad warns that too many new LNG facilities could spell a glut for export markets.

LNG, Crude Markets and Tariffs Muddy Analysts’ 2025 Outlooks

2024-12-12 - Energy demand is forecast to grow as data centers gobble up more electricity and LNG liquefaction capacity comes online in North America, but gasoline demand may peak by 2025, analysts say.

Dallas Fed: Trump Can Cut Red Tape, but Raising Prices Trickier

2025-01-02 - U.S. oil and gas executives expect fewer regulatory headaches under Trump but some see oil prices sliding, according to the fourth-quarter Dallas Fed Energy Survey.

First-half 2024's US LNG Exports Rise 3%, DOE Says

2024-10-11 - U.S. LNG exports rose 3% in the first half of 2024 compared to the same six month period in 2023 and the top 10 countries importing U.S. LNG accounted for 67% of the North American country’s LNG exports in the first half of 2024, according to a recent report from the U.S. DOE.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.